“Why is corporate investment lagging behind?”

“Why is corporate investment lagging behind?”

Syllabus: UPSC GS Paper III (Indian Economy – Investment, Growth & Demand)

Why in news:

India’s industrial production growth fell to a 9-month low of 1.2% (June 2024). Despite corporate tax cuts, public capital expenditure (capex), and low interest rates, private corporate investment remains sluggish.

Key Reasons for Lagging Corporate Investment:

1. Weak Demand Conditions:

-

Investment depends on demand for goods produced. Without robust demand, adding capacity leads to losses.

-

India is facing low demand in a slowing economy, deterring firms from investing.

2. Misreading Profit-Investment Causality:

-

Government assumed higher post-tax profits (due to corporate tax cut from 30% to 22%) would automatically trigger investment.

-

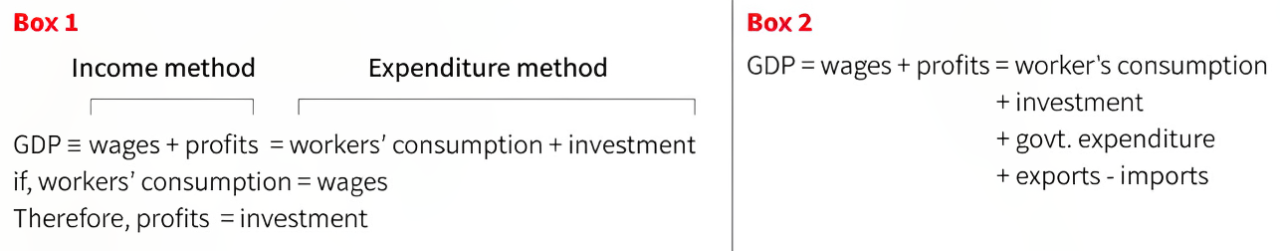

But, profits do not cause investment; rather, investment creates profits — as per Marxist economist Michał Kalecki.

-

Luxemburg’s counterpoint: Individual firms hesitate to invest when demand is low, even if collective investment would benefit the economy.

3. Government Capex Limitations:

-

Though government has increased capital spending, it has not effectively stimulated private investment due to:

-

Long gestation periods for infrastructure projects (e.g., ports).

-

High import content in capex (leakage of demand abroad).

-

Low labour intensity of big-ticket projects (limited impact on employment and consumption).

-

4. Ineffective Interest Rate Cuts:

-

Low interest rates alone cannot revive investment when demand remains weak.

-

Firms borrow only if they expect profitable returns, which isn’t viable in a demand-deficient economy.

Broader Economic Insight:

Keynesian View:

-

Recovery needs revival of both:

-

Speculative confidence (willingness to invest).

-

Credit access (willingness to borrow).

-

-

Weakness in either causes collapse; revival requires both.

Way Forward:

-

An exogenous demand stimulus is needed to revive investment:

-

Higher public expenditure (especially welfare or job-intensive schemes).

-

Export demand, though limited due to global economic slowdown.

-

-

Government policy must focus on creating domestic consumption to stimulate the investment-demand cycle.