Villages Power Over Half of India’s Manufacturing

Context

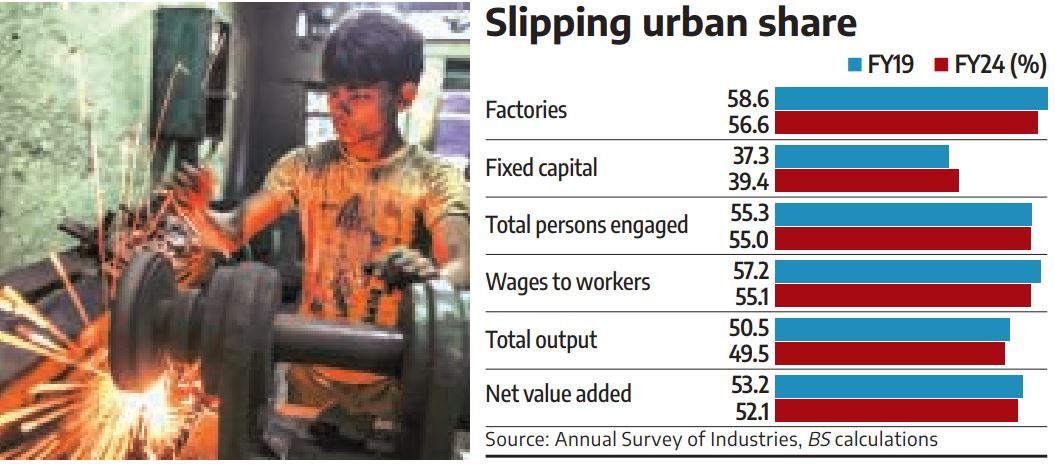

Annual Survey of Industries (ASI) 2023–24 shows that rural areas now contribute 50.5%+ of India’s formal manufacturing output.

Urban share slipped below 50% during the pandemic years and now stands at 49.5%, continuing a four-year rural dominance.

Key Findings

Output Trends: Urban share declined from 50.5% (2018–19) to 49.5% (2023–24).

Other Indicators: Decline in urban share of:

Number of factories

Persons engaged in manufacturing

Wages to workers

Net Value Added (NVA).

Causes:

High land prices and scarcity in cities.

Environmental concerns pushing factories to outskirts/rural belts.

Cities transforming into service hubs while manufacturing shifts outward.

Expert Views

Urban land scarcity and eviction of units drive rural relocation.

Industrial activity prefers rural/semi-urban zones due to pollution norms and resource constraints.

Cities increasingly service-driven (IT, finance, logistics).

Implications

Industrial Geography:

Shift towards peri-urban and rural clusters.

Emergence of new industrial belts outside metros.

Urbanisation vs. Growth Debate:

Urbanisation usually boosts productivity (ADB Institute, 2016).

Shift away may limit knowledge spillovers, labour market efficiency.

Employment & Migration:

Manufacturing slowdown (post-demonetisation, GST, pandemic) worsened job prospects.

Pushback to agriculture → higher disguised unemployment.

Structural Transformation:

2012 NBER study also noted rural relocation of plants, constrained by poor infrastructure and weaker education levels in rural areas.

India risks a premature deindustrialisation trend.