Viksit Bharat – Guarantee for Rozgar and Ajeevika Mission (Gramin) Bill, 2025 (VB–G RAM G Bill, 2025)

Theme: Reforming MGNREGA for Viksit Bharat 2047

Basic information

Introduced in Lok Sabha: 16 December 2025

Posted by Government: 18 December 2025

Ministry: Ministry of Agriculture and Farmers Welfare

Nature: New statutory framework

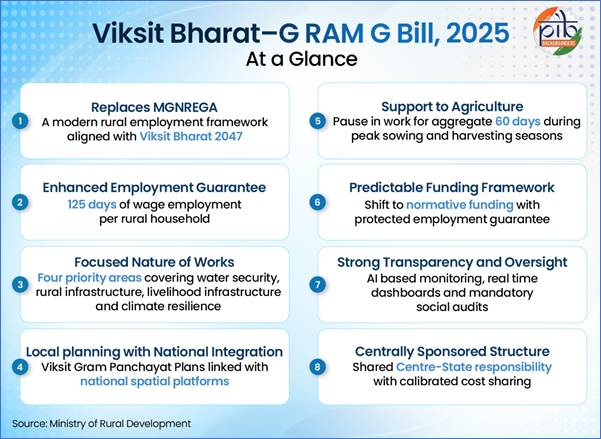

Replaces: Mahatma Gandhi National Rural Employment Guarantee Act, 2005 (MGNREGA)

Vision alignment: Viksit Bharat 2047

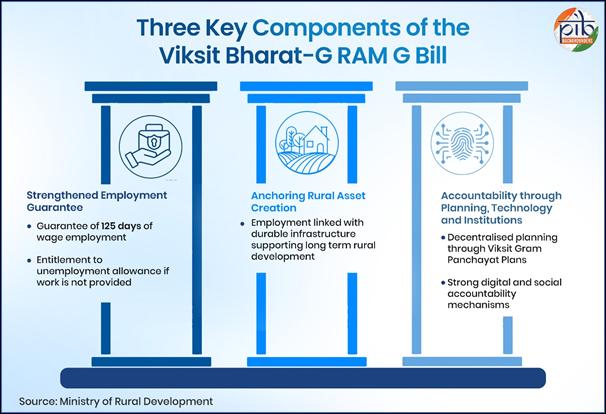

Core objectives

Strengthen rural income security

Align wage employment with durable rural infrastructure

Improve accountability, predictability, and fiscal discipline

Modernise rural employment in line with changed rural realities

Key takeaways

Employment guarantee enhanced from 100 to 125 days

Shift from demand-driven to normative funding

Conversion to a centrally sponsored scheme

Strong focus on infrastructure + climate resilience

Deep integration with digital governance and national planning systems

Background: Evolution of rural employment policy in India

Pre-MGNREGA phase

Rural Manpower Programme (1960s)

Crash Scheme for Rural Employment (1971)

National Rural Employment Programme

Rural Landless Employment Guarantee Programme

Jawahar Rozgar Yojana (1993)

Sampoorna Grameen Rozgar Yojana (1999)

Employment Assurance Scheme

Food for Work Programme

Turning point

Maharashtra Employment Guarantee Act, 1977

→ Introduced the idea of a statutory right to work

MGNREGA (2005)

First nationwide legal guarantee of wage employment

MGNREGA: Achievements and limitations

Achievements

100 days legal employment guarantee

Increased women participation (48% → 58.15%)

Near-universal digital wage payments

Expansion of Aadhaar-based payment systems

Large number of geo-tagged assets

Structural limitations

Misappropriation and ghost works

Mismatch between expenditure and physical progress

Use of machinery in labour-intensive works

Bypassing digital attendance

Few households achieving full 100 days post-pandemic

Weak administrative capacity at field level

➡️ Incremental reforms proved insufficient

Rationale for a new statutory framework

Rural poverty reduced sharply (27.1% in 2011–12 → 5.3% in 2022–23)

Rural livelihoods diversified beyond agriculture

Higher digital penetration and connectivity

Demand-driven open-ended funding became fiscally unpredictable

Need to link employment with long-term infrastructure and climate goals

Key features of VB–G RAM G Bill, 2025

A. Employment guarantee

125 days of wage employment per rural household per year

Applies to households whose adult members volunteer for unskilled manual work

Unemployment allowance retained

Payable by State government if work is not provided within 15 days

Liability rests with States

B. Pause during agricultural season

Mandatory no-work period of up to 60 days per year

Covers peak sowing and harvesting seasons

Ensures:

Availability of farm labour

Prevention of wage inflation in agriculture

Workers still get 125 days within remaining 305 days

C. Wage payment

Wages to be paid:

Weekly, or

Not later than 15 days (fortnight)

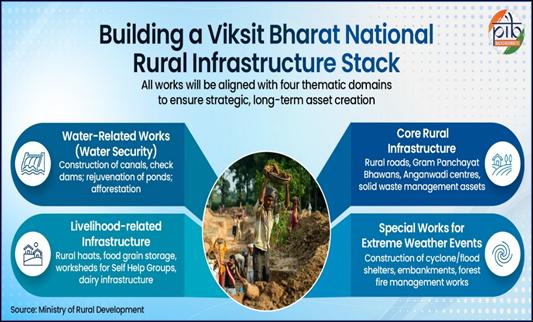

D. Priority areas for works (4 verticals)

Water security

Core rural infrastructure

Livelihood-related infrastructure

Mitigation of extreme weather events

E. Planning framework

Viksit Gram Panchayat Plans prepared locally

Integrated spatially with:

PM Gati Shakti National Master Plan

All assets aggregated into:

Viksit Bharat National Rural Infrastructure Stack

Plans aggregated from:

Gram Panchayat → District → State → National level

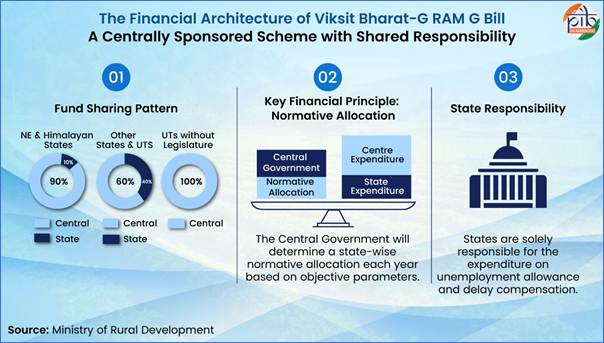

Financial architecture

Shift in funding model

From demand-based to normative allocation

Scheme becomes centrally sponsored

Normative funding means the government decides in advance how much money a State will get, using fixed rules (norms), instead of waiting for States to demand funds during the year. | ||

Cost-sharing pattern

60:40 – Centre : States

90:10 – North-Eastern and Himalayan States

100% Centre – Union Territories without legislatures

Key features

Centre decides state-wise normative allocation

States bear:

Unemployment allowance

Compensation for wage delays

Any expenditure beyond allocation

Why normative funding?

Improves budget predictability

Aligns with standard GoI budgeting practices

Prevents misuse and open-ended fiscal exposure

Does not dilute legal entitlement to employment

Financial magnitude

Total annual requirement: ₹1.51 lakh crore

Central share: ~₹95,692 crore

Administrative strengthening

Administrative expenditure ceiling raised:

From 6% to 9%

Enables:

Better staffing

Training

Technical capacity

Professional programme management

Institutional framework

Central and State Gramin Rozgar Guarantee Councils

Policy guidance

Review and monitoring

Steering Committees

National Steering Committee

Strategic oversight

Normative allocation recommendations

State Steering Committees

Convergence

Aggregation of plans

Coordination with Centre

Panchayati Raj Institutions

Gram Panchayats implement at least 50% of works (by cost)

Gram Sabhas:

Social audits (minimum once in six months)

Public oversight

Technology, transparency and accountability

Biometric authentication

AI-based irregularity detection

Geo-spatial and GPS-based monitoring

Mobile-based real-time dashboards

Weekly public disclosures

Strong enforcement powers to Centre:

Investigation

Suspension of funds

Corrective directions

Benefits

For rural households

Higher income security (125 days)

Predictable employment

Secure digital payments

Reduced distress migration

For farmers

Assured labour during peak seasons

Improved irrigation, storage, connectivity

Reduced wage volatility

For rural economy

Durable infrastructure creation

Climate resilience

Improved market access

Higher village-level consumption

Prelims Practice MCQs

Q. With reference to the Viksit Bharat – Guarantee for Rozgar and Ajeevika Mission (Gramin) Bill, 2025, consider the following statements:

It seeks to replace the Mahatma Gandhi National Rural Employment Guarantee Act, 2005.

It increases the guaranteed days of employment from 100 to 125 days in a financial year.

It removes the provision of unemployment allowance.

Which of the statements given above is/are correct?

A. 1 and 2 only

B. 2 and 3 only

C. 1 only

D. 1, 2 and 3

Correct answer: A

Explanation:

Statement 1 is correct: The Bill replaces MGNREGA, 2005.

Statement 2 is correct: Guaranteed employment is increased to 125 days.

Statement 3 is incorrect: The provision of unemployment allowance is retained.

Q. Which of the following expenditures will continue to be borne solely by State governments under the VB–G RAM G Bill, 2025?

Unemployment allowance

Compensation for delay in wage payments

Administrative costs

Material costs

Select the correct answer using the code below:

A. 1 and 2 only

B. 1, 2 and 3 only

C. 3 and 4 only

D. 1, 2, 3 and 4

Correct answer: A

Explanation:

Unemployment allowance and delay compensation remain State liabilities.

Wages, material, and administrative costs are shared between Centre and States.

Q. With reference to normative allocation under the VB–G RAM G Bill, 2025, consider the following statements:

The central government will determine state-wise normative allocation each year.

Parameters for allocation will be prescribed under Rules.

Expenditure beyond the normative allocation will be borne by the central government.

Which of the statements given above is/are correct?

A. 1 and 2 only

B. 2 and 3 only

C. 1 only

D. 1, 2 and 3

Correct answer: A

Explanation:

Statements 1 and 2 are correct.

Statement 3 is incorrect: States bear expenditure beyond normative allocation.