U.S. Stocks and Tax Implications in India

Legal Framework for Investing in U.S. Stocks from India

-

Liberalised Remittance Scheme (LRS) introduced in 2004.

-

Initially $25000 , Current remittance limit: $2,50,000 per financial year (for residents, including minors).

-

Permissible uses: Education, travel, investments including U.S. equities.

-

If remittance exceeds ₹10 lakh, Tax Collected at Source (TCS) applies:

-

TCS rates vary depending on the nature of remittance.

-

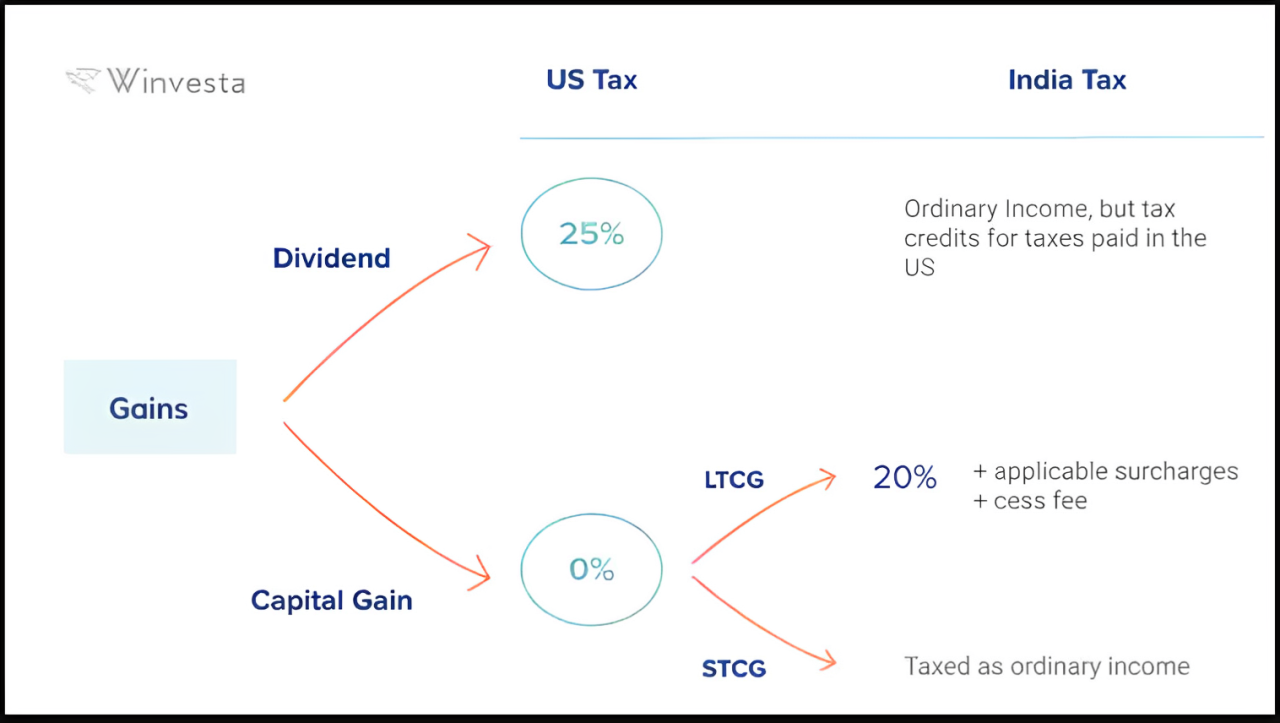

Taxation on U.S. Dividends

-

Dividend from U.S. stocks:

-

Treated as foreign income.

-

Subject to 25% withholding tax in the U.S..

-

Remaining 75% taxed in India as per slab rates.

-

-

Double Taxation Avoidance Agreement (DTAA):

-

India-U.S. DTAA allows foreign tax credit for tax already paid in U.S.

-

To claim benefit: File Form 67 before Indian ITR filing.

-

Challenges in claiming:

-

Different financial years (U.S.: Jan–Dec vs India: Apr–Mar).

-

Exchange rate differences.

-

Timing and documentation mismatches.

-

-

Capital Gains Tax on U.S. Stocks

-

No capital gains tax in U.S. for Indian NRAs (Non-Resident Aliens).

- But India taxes all capital gains from U.S. equities:

| Holding Period | Tax Type | Rate |

|---|---|---|

| > 24 months | LTCG | 20% + surcharge + cess |

| ≤ 24 months | STCG | Taxed as per income slab |

-

Governed under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015.

-

Mandatory to disclose all foreign assets (stocks, bank accounts, etc.) under Schedule FA in ITR.

-

Penalties for non-disclosure:

-

₹10 lakh per year per asset.

-

Imprisonment up to 7 years in extreme cases.

-

-

Even if:

-

Stock is not sold (no gains/losses),

-

Value is negligible (even $1),

-

Dividend is minimal,

-

Still must be declared.

-