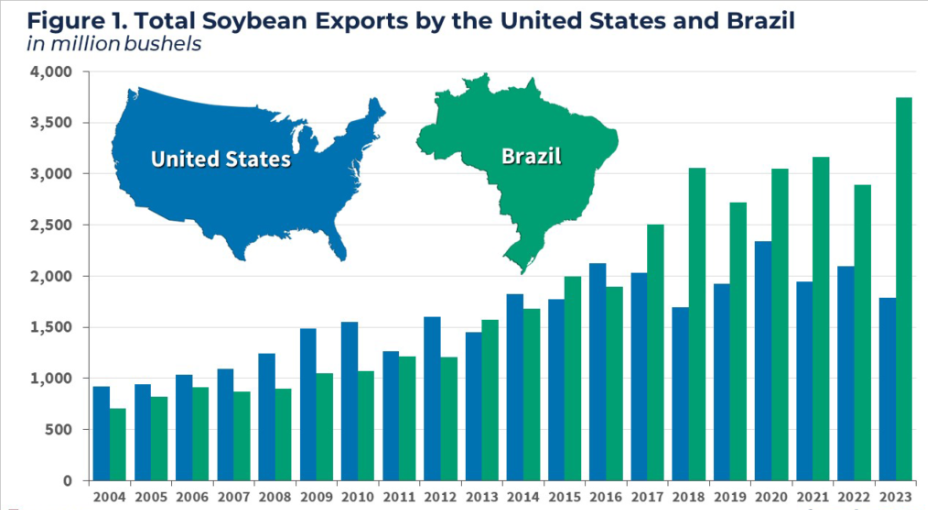

U.S. Losing Out on China Soybean Sales as Brazil Fills In

Background

-

Issue: U.S. soybean exporters risk losing billions in sales to China due to ongoing trade tensions and tariffs.

-

Main Competitor: Brazil is capturing the Chinese market during the key U.S. marketing season.

-

China: Top global importer of soybeans (~105 million metric tons in 2024).

Market Pattern

-

Normal seasonality:

-

Sep–Jan: U.S. soybeans dominate Chinese imports.

-

Post-February: Brazil’s harvest takes over supply.

-

-

Change in 2024: Brazil is supplying even during the U.S. peak window.

Reasons for China’s Shift

-

Trade tensions & tariffs – introduced during Trump presidency; still unresolved.

-

Supply security – heavy Q3 purchases from Brazil to build inventories ahead of possible Q4 risks.

-

Policy shift – reduced dependence on U.S. agriculture since start of trade war.

Impact

-

Potential loss for U.S.: Billions of dollars in missed sales.

-

Pressure on Chicago soybean futures – already near five-year lows.

-

Brazil strengthens market position (world’s largest exporter, >53 million metric tons/year)

Key Figures

Global Scenario (2024–25 estimates – Source: Exportimportdata.in)

-

Brazil – Largest producer; over 160 million metric tons.

-

United States – About 120 million metric tons.

-

Argentina – Around 50 million metric tons.

-

China – ~20 million metric tons; major importer due to high domestic demand.

-

India – ~13 million metric tons; showing a growing trend.

India – State-wise Production

-

Madhya Pradesh – Largest producer, called the “Soybean State”.

-

Maharashtra – 2nd largest producer.

-

Rajasthan – Significant producer.