Tax reforms (GST revamp + new Income-Tax Bill):

Key Features of Proposed GST Reform

-

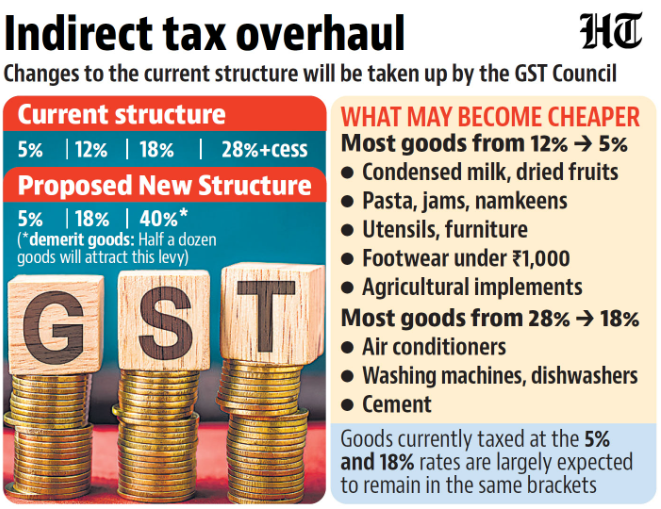

New GST Structure

-

Two-tier GST: 5% and 18%.

-

40% slab for sin goods (tobacco, luxury liquor, etc.).

-

Abolition of 12% and 28% slabs.

-

Removal of compensation cess.

-

-

Inclusion of Petroleum Products

-

Petrol & diesel under GST deferred due to energy price volatility.

-

May be considered in next round of reforms.

-

-

Rate Rationalisation

-

Cement: 28% → 18% (expected to cut real estate & infra costs).

-

Automobiles & auto parts: 28% → 18% (boost demand & reduce costs).

-

Luxury/ultra-premium cars may continue to face higher incidence.

-

-

Institutional Strengthening

-

Simplified input tax credit (ITC) system.

-

Stronger GST tribunals for dispute resolution.

-

Income-Tax Bill (Direct Tax Overhaul)

-

Recently passed by Parliament; forms part of a complete revamp of direct + indirect tax system.

-

Aimed at simplification, widening tax base, and reducing compliance burden.

Government’s Position

-

PM Modi: Draft circulated to states; seeks rollout before Diwali 2025.

-

Framed as “reform with good governance”, intended to ease life & business.

-

Fiscal deficit target for FY26: 4.4% of GDP, despite expected revenue dip.

Impact Assessment

1. On Consumers

-

Lower tax burden on essentials & big-ticket items like housing and vehicles.

-

Cheaper cement → reduced housing & infrastructure costs.

-

Cheaper auto parts → reduced maintenance costs.

-

Lower duty burden likely to increase affordability.

2. On Businesses

-

Reduced rates → potential demand boost in auto, housing, infra sectors.

-

Simpler ITC regime → easier compliance for MSMEs & large firms.

-

Anti-profiteering provisions relaxed; extent of consumer benefit depends on market pass-through.

3. On States & Revenues

-

Short-term revenue loss (e.g., ₹33,000 crore from cement + auto rate cut).

-

Long-term gain from higher consumption demand and tax buoyancy.

-

States benefit politically by showcasing reduced tax burden on citizens.

4. On Overall Economy

-

Housing push aligns with government’s affordable housing & infra expansion targets.

-

Auto demand revival could support manufacturing & jobs.

-

Rationalisation seen as pro-consumer, pro-growth, while maintaining fiscal prudence.