Shadow banking

Meaning

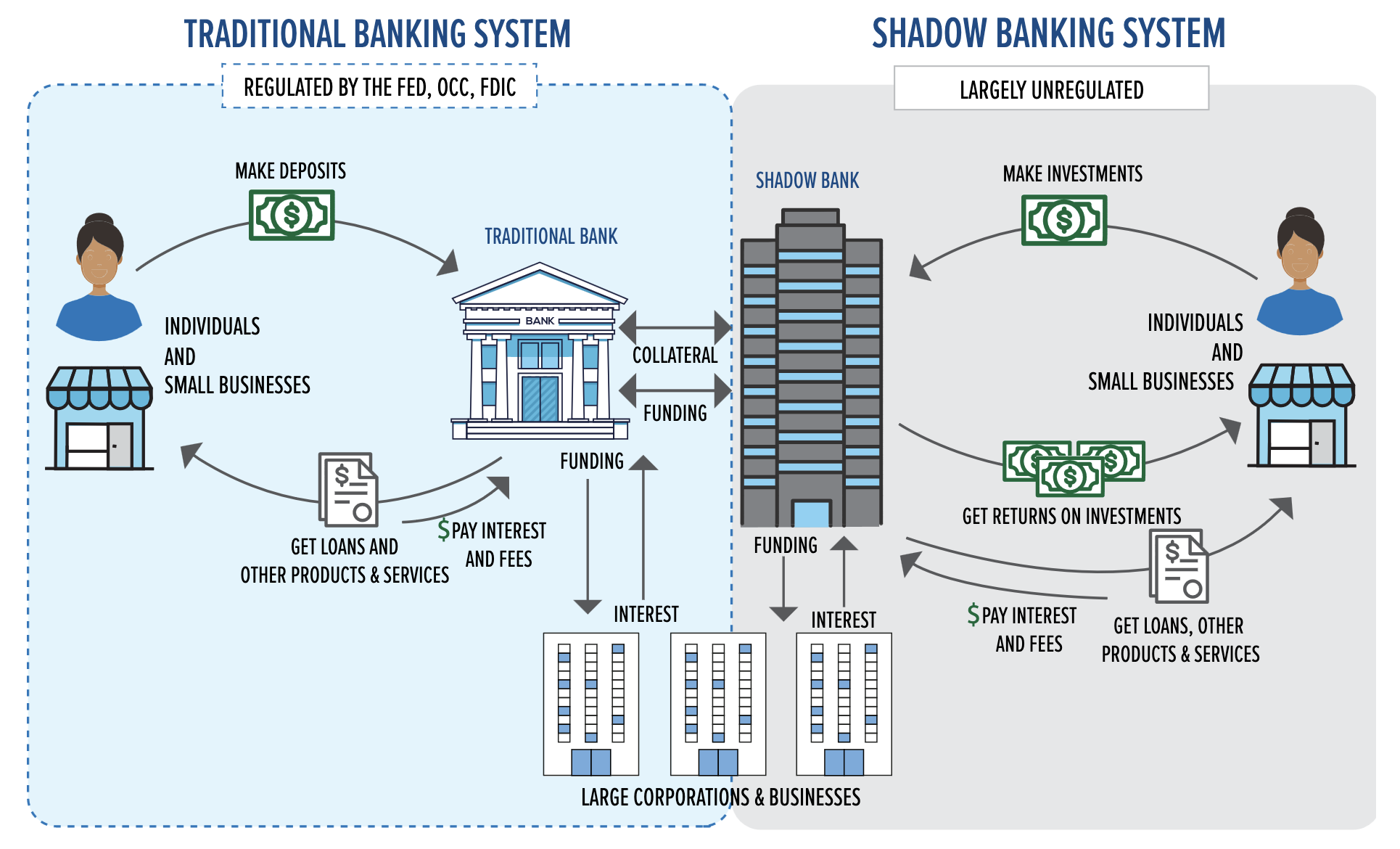

Shadow banks = market-based finance / non-bank financial institutions operating outside traditional banking regulation.

Do not take deposits from the general public; hence lower regulatory scrutiny.

Growth and scale

Shadow banks’ share of global financial assets: ~47% in 2022 (up from 25% in 2007–08).

Conventional banks’ share: ~40%.

Growth is global, accelerated after the 2008 crisis.

Key entities in shadow banking

Asset managers: insurance firms, pension funds, investment funds, hedge funds.

Non-bank financial companies (NBFC-type structures).

Collective investment vehicles.

Securitisation vehicles.

Microloan agencies, trade financiers, asset-based lenders, payday lenders, pawn shops.

China-specific forms: wealth management products, trust loans, undiscounted bank acceptance bills.

Securitization is the process of pooling various types of debt (like mortgages, auto loans, or credit card debt) and packaging them into a financial asset called a security, which is then sold to investors.

This allows the original lender to free up capital for new lending while providing investors with a new source of income from the interest and principal payments of the underlying assets.

Common features

Act as intermediaries of capital flows between investors and businesses.

Trade in financial markets using diverse strategies.

Light regulation because they do not take deposits and are outside payment systems.

Provide credit to segments banks withdraw from.

Why shadow banking expanded

Tighter bank regulation post-2008 (Basel III) → banks reduced lending to riskier or small borrowers; shadow banks filled the gap.

Low interest rates (2008-2021) → investors chased higher yields.

Bank NPAs in Asia → banks unable to meet loan demand.

Regulatory arbitrage: differences in capital, liquidity, leverage norms.

Demand for safe assets:

Central banks (US Fed, BoE, BoJ, ECB) hold large portions of government debt.

Highly rated securitised debt meets collateral needs.

Banks’ gains from shadow banking growth

Banks shift from “storage” (holding loans) to “moving” (underwriting and distributing loans).

Higher returns by sweating capital.

Use of off-balance-sheet hedge funds created by ex-in-house traders → profit from trading and derivatives.

Banks provide leverage and services (clearing, custody) to these funds.

Risks posed by shadow banks

Difficult to measure debt buildup → fuels asset price bubbles.

Higher risk lending:

Lower-rated borrowers

Riskier collateral

High leverage beyond what regulated banks can take.

Collateral-based lending vulnerabilities (collateral quality often questionable).

No permanent loss-absorbing capital → many are pass-through funds.

Severe liquidity and redemption risk:

Fully invested, minimal cash buffers

Asset–liability mismatches

Illiquid asset holdings

Contagion to regulated banks:

Greensill Capital and Archegos contributed to Credit Suisse’s collapse.

Demonstrates tight interconnections with banks.

Opacity and complexity → risk underestimation.

Prelims Practice MCQs

Q. Which of the following best explains the post-2008 global growth of shadow banking?

A. Improved deposit insurance schemes

B. Expansion of central bank balance sheets and stricter bank regulations

C. Rapid growth of public sector banks in developing economies

D. Complete prohibition of securitisation by commercial banks

Correct answer: B

Explanation:

Basel III tightened lending → banks pulled back.

Central banks bought government debt → demand for alternative safe assets → securitisation growth.

Both factors boosted shadow banking.

Q. Shadow banks pose systemic risks mainly because:

They operate with higher leverage.

They hold permanent loss-absorbing capital equivalent to banks.

They depend heavily on short-term funding.

They are deeply interconnected with regulated financial institutions.

Select the correct answer:

A. 1, 2 and 3

B. 1, 3 and 4

C. 2 and 4 only

D. 1 and 4 only

Correct answer: B

Explanation:

They have no permanent loss-absorbing capital (statement 2 incorrect).

High leverage, short-term funding, and interconnections all raise systemic risk.

Q. Which of the following is a major reason for regulatory arbitrage benefiting shadow banks?

A. Shadow banks are legally prohibited from raising capital.

B. Regulated banks have uniform global liquidity norms.

C. Capital, leverage, and liquidity rules differ between banks and non-banks.

D. Shadow banks must follow the same prudential norms as commercial banks.

Correct answer: C

Explanation:

Differences in regulation create space for activity to migrate into lightly regulated entities.