Palm Oil Sector – Challenges and Outlook

Context

-

Major palm oil exporters like Malaysia and Indonesia are facing a potential supply crisis.

-

Key causes: Ageing oil palm trees, reluctance to replant, and ageing smallholder farmers.

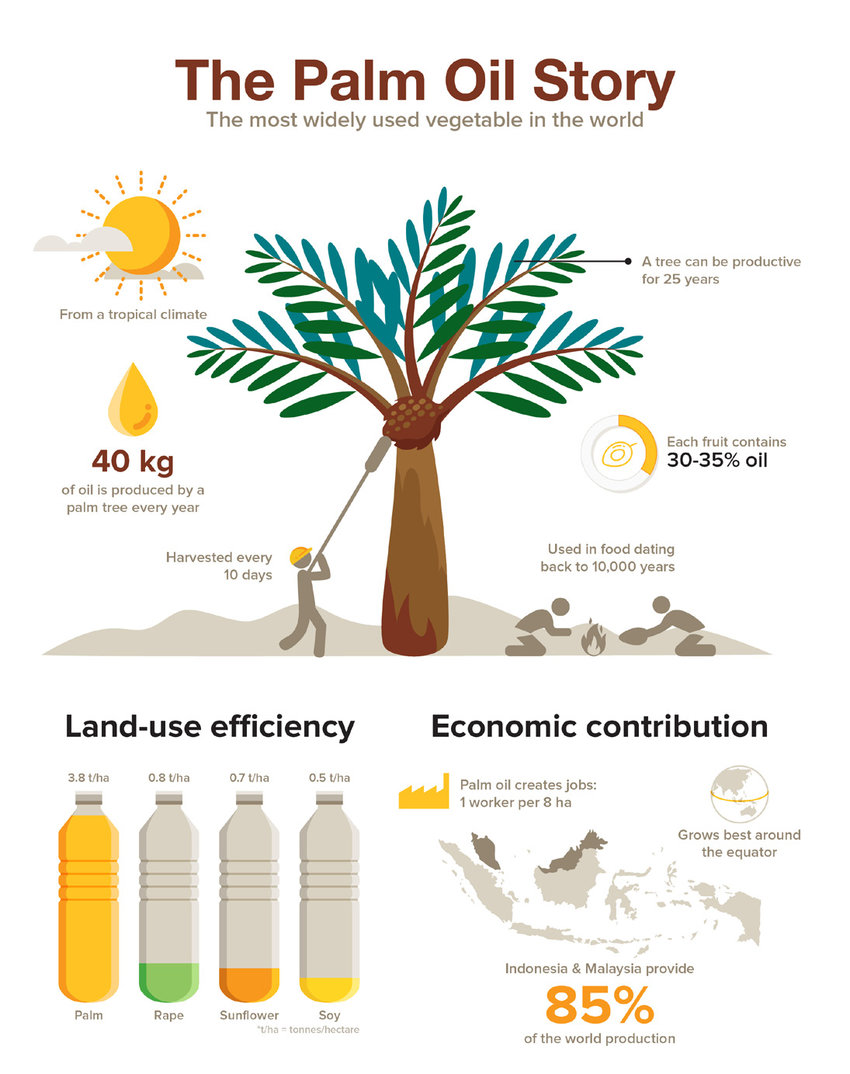

- Palm oil is an African tree in the palm family (Arecaceae), cultivated as a source of oil.

- Distribution: It is grown extensively in its native West and Central Africa, and Malaysia and Indonesia. Due to its high demand, plantations are spreading across Asia, Africa and Latin America.

Key Data Points

-

Palm oil accounts for over 50% of global vegetable oil supply.

-

85% of crude palm oil is produced by Malaysia and Indonesia.

-

Smallholders contribute 40% of total production in both countries.

-

Combined exports may decline by 20% by 2030 over 2024 levels.

Reasons for Decline in Production

1. Ageing Trees

-

Palm trees over 20 years old are past peak production.

-

Malaysia: Govt data – 37% smallholder plantations past peak; Experts estimate – >50%.

-

Indonesia: Targeted replanting of 2.5 million ha by 2025; only 10% achieved by Oct 2024.

2. Ageing Farmers

-

Farmers hesitant to replant due to:

-

3–5 years waiting period for new trees to yield.

-

Reduced replanting subsidies.

-

Need for continuous income to support families.

-

3. Policy Shifts

-

Indonesia’s biodiesel mandates: Increased domestic consumption.

-

Efforts to divert palm oil into biofuel production reduce exportable surplus.

Impact on Global Market

-

Global prices of palm oil (used in food, cosmetics, cleaning products) may rise.

-

Financial markets already pricing in slowdown, but extent underestimated due to underreported field realities.

Implications

-

Food security concerns in importing countries like India, China, EU.

-

Sustainability challenges: Slow replanting affects long-term supply.

-

Necessity for policy innovation to support rejuvenation of plantations and incentivise younger farmers.

Way Forward

-

Enhance subsidies and incentives for replanting.

-

Launch targeted schemes for smallholders and promote youth participation in palm cultivation.

-

Increase transparency in data on plantation health and replanting status.

National Mission on Edible Oils – Oil Palm (NMEO-OP)

Launch Year: 2021–22

Type: Centrally Sponsored Scheme

Implementing Agency: Ministry of Agriculture & Farmers Welfare

Objective

-

To enhance domestic production of edible oils by increasing area under oil palm cultivation and improving productivity.

Aim

-

Reduce India’s heavy import dependence on edible oils, especially palm oil (India imports ~60% of its edible oil demand).

Funding Pattern

-

80% share by Government of India

-

20% share by State Governments

Special Focus Regions

-

North-Eastern States

-

Andaman & Nicobar Islands

15 states covered under the scheme including:

-

Arunachal Pradesh

-

Assam

-

Manipur

-

Mizoram

-

Nagaland

-

Tripura

Salient Features

-

Planting Material Support

-

Financial assistance for quality planting material to boost initial productivity.

-

-

Intercropping Support

-

Inputs for intercropping (alternative crops grown between oil palm rows) during the gestation period of 4 years.

-

-

Maintenance Support

-

Support for maintenance of plantations until maturity.

-

-

Price Assurance Mechanism

-

Ensures farmers get Minimum Support Price–like security through a Viability Price Formula.

-

-

Viability Gap Funding (VGF)

-

Central support to cover the gap between actual cost and market viability to make projects economically feasible.

-

Significance

-

Helps tackle:

-

Food security concerns

-

Rising edible oil prices

-

Supply shocks due to import dependency (like during Ukraine War or Indonesia’s export bans)

-

-

Aligned with Atmanirbhar Bharat and Doubling Farmers’ Income targets.