Money laundering and Prevention of Money Laundering Act (PMLA) 2002

Current Status (As per Finance Minister’s Report)

-

Cases under PMLA (since 2015): 5,892

-

Convictions: 15

-

Conviction rate: ~0.25%

-

Overall:

-

Conviction rate is very low.

-

Indicates rising trend of money laundering.

-

Questions effectiveness of law enforcement.

-

What Is a Laundromat?

-

Definition: A financial structure used to launder money.

-

Functions:

-

Launder crime proceeds.

-

Evade taxes and currency restrictions.

-

Hide ownership of assets.

-

Move money offshore.

-

-

Often disguised as banks or financial institutions.

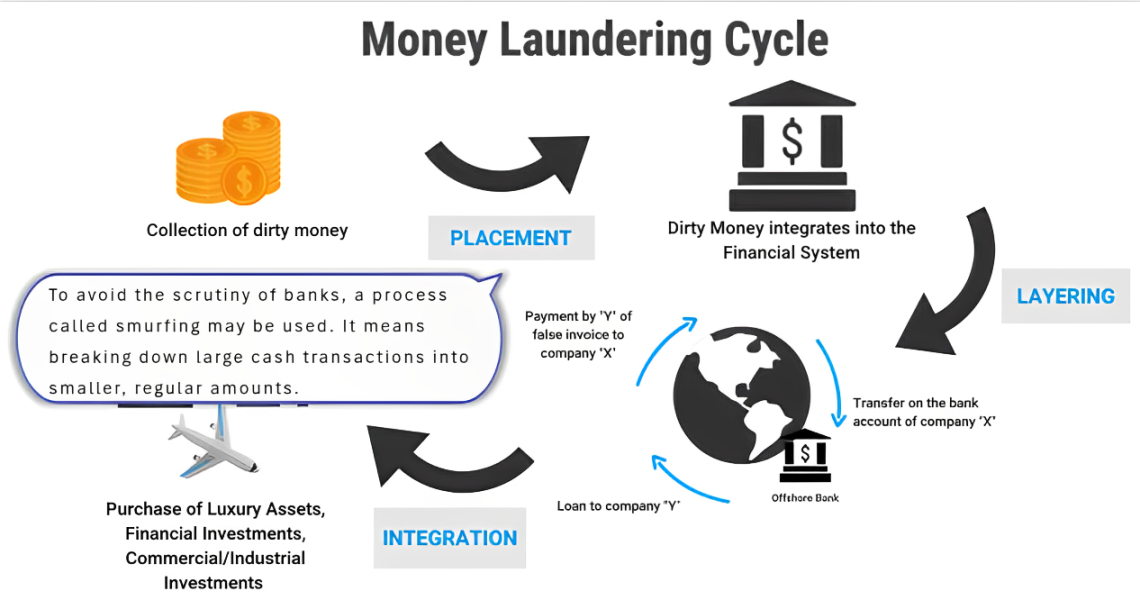

Three Stages of Money Laundering

-

Placement:

-

Dirty money is introduced into the financial system.

-

Method: Smurfing (breaking large sums into smaller ones).

-

-

Layering:

-

Money is moved through complex transactions or offshore accounts to obscure origin.

-

-

Integration:

-

The 'cleaned' money re-enters the economy (e.g., real estate, businesses, luxury assets).

-

Legal Framework: Prevention of Money Laundering Act (PMLA), 2002

-

Key Provisions:

-

Burden of proof lies on the accused.

-

No FIR required; ECIR (Enforcement Case Information Report) is sufficient to begin proceedings.

-

Scheduled offence is needed for prosecution under Section 3.

-

Attachment of property under Section 5 can occur without a pre-registered case.

-

Notable Supreme Court Judgements

-

P. Chidambaram vs ED (2019):

-

Money laundering undermines financial stability, sovereignty, and national integrity.

-

-

Vir Bhadra Singh vs ED (2017):

-

ECIR is enough to start investigation; FIR not required.

-

-

Vijay Madanlal Chaudhury vs Union of India (2022):

-

Scheduled offence needed for prosecution.

-

But property can be attached without pre-registered case → often misused for political motives.

-

Double Taxation Avoidance Agreement (DTAA)

-

Signed with: ~85 countries

-

Purpose:

-

Prevent double taxation.

-

Facilitate information exchange on tax matters.

-

Enhance enforcement of tax laws.

-

Helps curb tax evasion and money laundering across borders.

-

Challenges

-

Rising number of cases, but extremely low convictions.

-

Potential misuse of PMLA by authorities.

-

Lack of clear prosecution mechanisms.

-

Terror funding link adds urgency to address the issue.

Recommendations to Tackle Money Laundering

-

Strict, transparent implementation of PMLA.

-

Prevent political misuse of investigation powers.

-

Align fully with FATF (Financial Action Task Force) standards.

-

Strengthen international cooperation via DTAA and global treaties.

-

Improve investigative quality to enhance conviction rates.

-

Use technology & data analytics for tracking suspicious transactions.

-

Conduct periodic audits of financial institutions.