India's exports Conundrum

Context

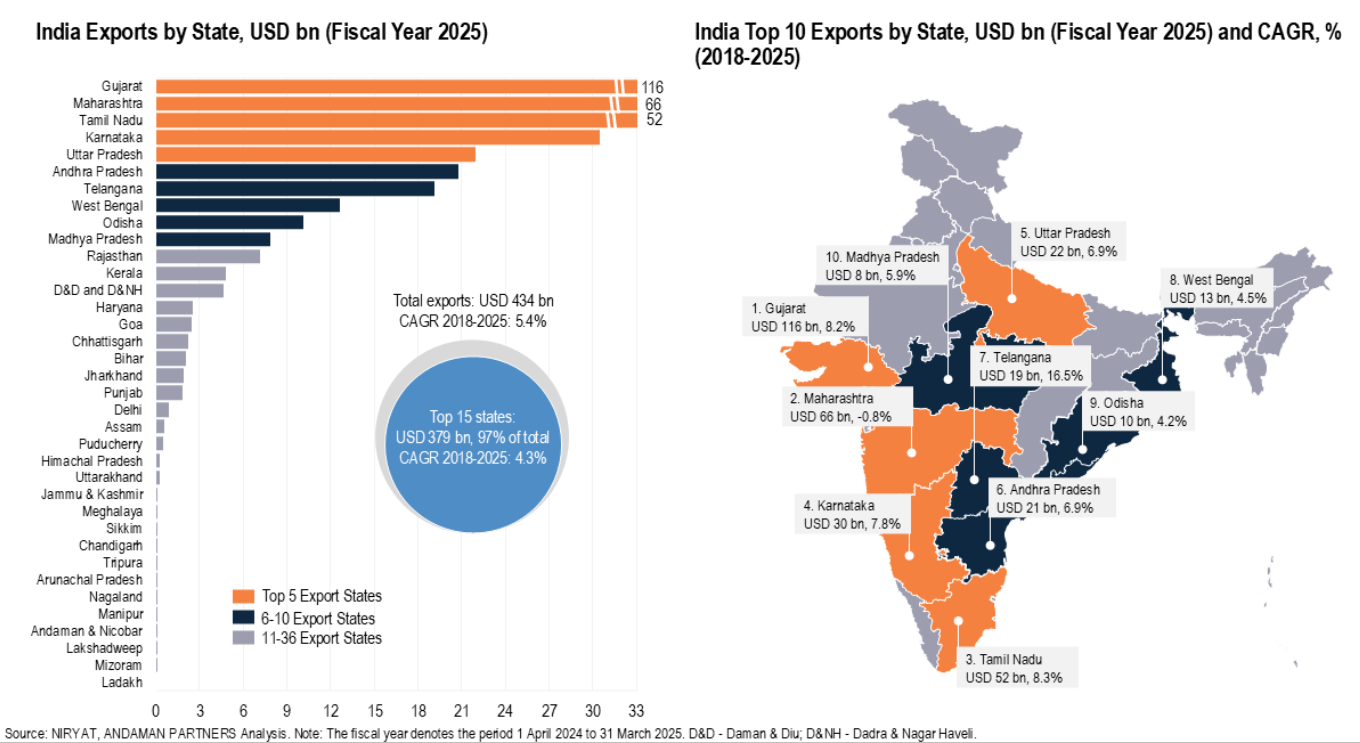

India’s export performance looks strong at the national level, but this success is highly concentrated geographically. A small group of States dominate exports, while large parts of the country remain disconnected from global trade and industrial growth.

Core-periphery pattern in India’s exports

Export concentration

Top five States: Maharashtra, Gujarat, Tamil Nadu, Karnataka, Uttar Pradesh

Together account for nearly 70% of India’s exports

Five years ago, their share was about 65%, showing rising concentration

This creates a core-periphery structure:

Coastal and industrial States integrate deeper into global value chains

Northern and eastern hinterland States lag behind

Measuring concentration

Rising Herfindahl-Hirschman Index (HHI) for export geography

Indicates exports are becoming more agglomerated, not dispersed

Herfindahl–Hirschman Index (HHI) The Herfindahl–Hirschman Index (HHI) is a statistical measure of concentration. It shows how much a market, sector, or activity (such as exports) is dominated by a few players or regions. | ||

Key insight: National averages hide growing regional divergence.

Global context: Why lagging States are not catching up

Shrinking space for labour-intensive exports

Global merchandise trade volume growth has slowed to 0.5–3% (WTO data)

Top 10 exporters control ~55% of global trade (UNCTAD, 2023)

Capital is no longer chasing cheap labour alone.

Instead, it seeks:

High economic complexity

Dense supplier networks

Reliable logistics and institutions

World Trade Organization

UN Trade and Development

Shift from volume to value in exports

Economic complexity logic

Sophisticated products (machinery, automobiles, electronics) cluster in dense “core” product spaces

Regions exporting simple, low-complexity goods face high entry barriers to upgrade

Result:

Advanced regions keep moving up the value chain

Backward regions get locked out

Capital deepening and the broken employment link

End of the old development pathway

Earlier theory assumed:

Exports → Industrialisation → Mass factory employment

This link is now broken.

Evidence from industry

Annual Survey of Industries (ASI) 2022–23:

Fixed capital growth: ~10.6%

Employment growth: ~7.4%

Fixed capital per worker: ₹23.6 lakh

This shows capital deepening: more machines per worker, fewer jobs per unit of output.

Capital deepening means each worker is using more machines, tools, and technology than before. | ||

Labour market confirmation

PLFS findings

Manufacturing employment share stuck at ~11.6–12%

No major shift of workers from agriculture to factories

Employment elasticity of exports has collapsed

Meaning: Export growth no longer guarantees job creation.

Capital over the worker

Wage share in Net Value Added (NVA) is declining

Productivity gains in automated sectors accrue mainly to capital owners

Explains:

High GDP growth in export States

Limited mass prosperity

Even fast-growing sectors like electronics exports (PLI-driven, +47% YoY) remain spatially sticky, concentrated in districts such as Kancheepuram and Noida due to logistics and complexity requirements.

Financial roots of regional divergence

Credit-Deposit (CD) ratio divide

Export hubs (Tamil Nadu, Andhra Pradesh): CD ratio > 90%

Hinterland States (Bihar, eastern Uttar Pradesh): CD ratio < 50%

This implies:

Savings from poorer States are lent to richer industrial regions

A form of internal capital drain

Weak state capacity, low financial depth, and human capital deficits reinforce this vicious cycle.

Prelims Practice MCQs

Q. The rising Herfindahl-Hirschman Index (HHI) of India’s exports indicates:

a) Greater diversification of exports

b) Declining role of coastal States

c) Increasing concentration of exports in few States

d) Equal regional participation in trade

Answer: c

Explanation: A higher HHI reflects greater concentration, not dispersion.

Q. Why is export growth no longer generating mass industrial employment in India?

a) Decline in global demand

b) Capital deepening and automation

c) Excessive labour regulations

d) Rise of services exports

Answer: b

Explanation: Fixed capital is growing faster than employment, reducing labour absorption.

Q. A low Credit-Deposit ratio in hinterland States mainly indicates:

a) Excessive borrowing

b) Capital flight to other regions

c) Higher household consumption

d) Strong industrial investment

Answer: b

Explanation: Deposits are mobilised locally but lent elsewhere.