Financial Fraud Risk Indicator (FRI)

What is FRI?

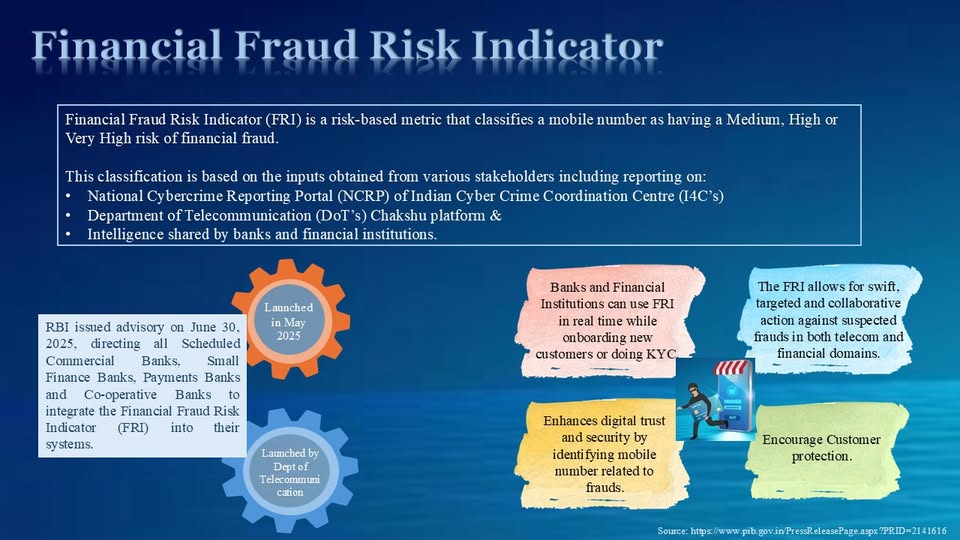

Financial Fraud Risk Indicator (FRI) is a national-level early warning mechanism to prevent cyber-enabled financial frauds.

It uses intelligence sharing, data analytics, and citizen inputs to flag high-risk fraud patterns in real time.

Launch and implementation

Launched: 22 May 2025

Implementing ministry: Department of Telecommunications (DoT)

Platform: Digital Intelligence Platform (DIP)

Key achievements (as per latest data)

₹660 crore worth of cyber fraud losses prevented within six months

1,000+ entities onboarded on DIP, including:

Banks

Third-Party Application Providers (TPAPs)

Payment System Operators (PSOs)

How FRI works

Citizen reports suspected frauds and telecom misuse

Inputs flow into Sanchar Saathi

Data is analysed on DIP

FRI flags high-risk patterns

Alerts shared with banks, payment operators, regulators

Preventive action (blocking, monitoring, warnings)

Role of Sanchar Saathi

Citizen-facing portal and mobile app of DoT

Functions as a crowdsourced cyber-intelligence tool

Citizens can report:

Fraudulent calls/messages

SIMs issued in their name

Lost or stolen mobile phones

Embodies Jan Bhagidari (public participation)

How FRI protects UPI users (working mechanism)

Mobile number proposed for a transaction is checked

FRI assigns a risk score

Score is shared with banks/TPAPs via secure APIs

If number is high-risk:

Transaction may be blocked, or

On-screen warning is shown to user

Fraud loss is prevented before money is transferred

👉 FRI acts as a “soft signal”, enabling preventive action, not post-fraud recovery.

Institutional support and coordination

FRI is backed by multi-agency cooperation, including:

Department of Telecommunications

Reserve Bank of India

National Payments Corporation of India

Securities and Exchange Board of India

Pension Fund Regulatory and Development Authority

Banks, financial institutions, PSOs, TPAPs

Digital Intelligence Platform (DIP)

What is the Digital Intelligence Platform (DIP)?

Digital Intelligence Platform (DIP) is a secure, real-time national backend system for sharing intelligence on misuse of telecom resources in cyber and financial frauds.

Developed by the Digital Intelligence Unit (DIU) under the Department of Telecommunications.

Acts as a coordination bridge between telecom data and financial systems.

Key institutions involved

Department of Telecommunications – Nodal implementing authority

Reserve Bank of India – Financial oversight and standardisation

National Payments Corporation of India – UPI and payment ecosystem integration

Banks, TPAPs, PSOs, State Police, Central Security Agencies

Social media platforms (e.g. WhatsApp)

Scale and coverage

1,050+ organisations onboarded

Includes:

Banks and financial institutions

Third-Party Application Providers (TPAPs)

UPI operators

Law-enforcement agencies

Financial Fraud Risk Indicator (FRI)

Core component of DIP

Launched in May 2025

A risk-based metric that classifies mobile numbers as:

Medium risk

High risk

Very High risk

Data sources feeding FRI

Chakshu facility

National Cybercrime Reporting Portal (NCRP)

Citizen reports via Sanchar Saathi

Inputs from banks, payment operators, and law-enforcement agencies

Prelims Practice MCQs

Q. With reference to the Digital Intelligence Platform (DIP), consider the following statements:

It is a secure platform for sharing intelligence related to misuse of telecom resources.

It has been developed under the Department of Telecommunications.

It replaces the role of law-enforcement agencies in investigating cybercrime.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Correct answer: (a) 1 and 2 only

Explanation:

Statements 1 and 2 correctly describe DIP. Statement 3 is incorrect because DIP supports prevention and coordination, not investigation or prosecution.

Q. Consider the following statements regarding the Financial Fraud Risk Indicator (FRI):

It assigns risk levels to mobile numbers used in digital payments.

It functions as a legally binding blacklist maintained by RBI.

It is integrated into banking and UPI systems through APIs.

How many of the above statements are correct?

(a) Only one

(b) Only two

(c) All three

(d) None

Correct answer: (b) Only two

Explanation:

Statements 1 and 3 are correct. Statement 2 is incorrect because FRI is a soft signal, not a legal blacklist.