Code on Social Security, 2020

Introduction

The Code on Social Security, 2020 consolidates nine existing social security laws into one unified framework.

Objective:

Universalise social protection

Extend coverage to organized, unorganized, gig and platform workers

Promote gender inclusion and ease of doing business

Benefits strengthened:

Life & disability insurance

Health and maternity care

Provident fund

Gratuity

Implementation strengthened through:

Digital systems

Technology-driven inspections

Decriminalisation and compounding provisions

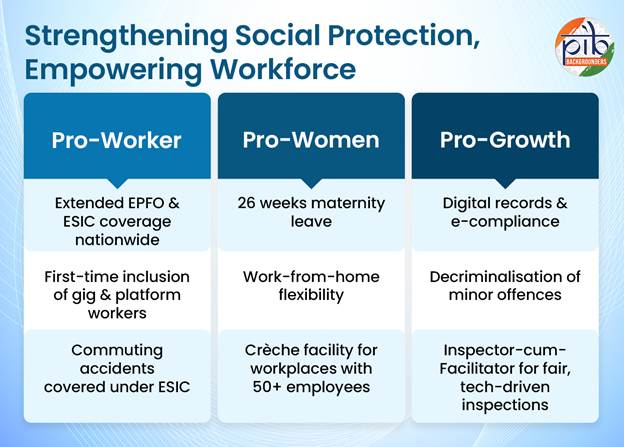

Key Takeaways from the Code

Universal social protection across workforce categories.

Nationwide applicability of EPFO and ESIC.

Formal recognition of gig and platform workers.

Strong women-centric social security measures.

Simplified compliance, digitalization, and business facilitation.

Pro-worker Provisions

1. Gratuity for fixed-term employees

Eligibility reduced from 5 years to 1 year of continuous service.

Gratuity payable on a proportionate basis.

2. Coverage of gig and platform workers

First-time legal recognition under Sections 113 & 114.

Includes definition of aggregators (digital intermediaries).

Welfare measures include:

National Social Security Board (policy & monitoring)

State Social Security Boards

Dedicated Social Security Fund (CSR, penalties, govt contributions)

Section 13 allows adding more welfare functions in future.

3. Universal EPFO coverage

Schedule-based applicability removed.

EPF applies to all establishments with 20+ employees, regardless of industry.

Reduces litigation and extends retirement security.

4. National registration and unique identification

Creation of National Database of Unorganized Workers.

Workers receive a Unique Identification Number, Aadhaar-verified.

Enables portability of benefits for migrant workers.

5. Uniform definition of wages

Wages include:

Basic pay

Dearness allowance

Retaining allowance

If allowances exceed 50% of total remuneration, excess added back to wages.

Results in higher contributions → greater social security benefits.

6. Expanded definition of “family”

Includes:

Mother-in-law, father-in-law (with income cap)

Minor unmarried dependent siblings (if parents are deceased)

More family members become eligible for ESIC benefits.

7. Commuting accidents covered

Accidents during travel between home and workplace treated as occurring “in the course of employment”.

Compensation and ESIC benefits now applicable.

8. ESIC coverage expanded

Nationwide coverage; removal of “notified area” restriction.

Voluntary ESIC membership for establishments with fewer than 10 workers.

Mandatory ESIC for hazardous occupations even with one worker.

Plantations can opt into ESIC system.

Pro-women Provisions

1. Maternity benefits

Eligibility: 80 days’ work in preceding 12 months.

26 weeks of maternity leave (8 weeks pre-delivery).

12 weeks for adoptive or commissioning mothers.

2. Work-from-home option

Employers may offer WFH to returning mothers where work permits.

3. Simplified certification

Proof of maternity conditions can be issued by:

Registered medical practitioner

ASHA worker

Auxiliary nurse

Midwife

4. Medical bonus

₹3,500 medical bonus if free pre/post-natal care not provided.

5. Nursing breaks

Two nursing breaks/day until the child is 15 months old.

6. Crèche facilities

Mandatory for establishments with 50+ employees.

Gender-neutral requirement.

Common crèches allowed (Govt, private, NGOs).

If no crèche, employer must pay ₹500/month per child (up to 2 children).

Pro-growth Provisions

1. Digitalisation

Electronic maintenance of all records.

Reduces compliance burden and improves efficiency.

2. Time-bound inquiry

EPF inquiries must start within 5 years.

Completion within 2 years, extendable by 1 year with approval.

3. Reduced deposit for appeals

Deposit reduced to 25% (earlier 40–70%) for appeals to the tribunal.

4. Self-assessment of cess

For construction sector.

Ensures faster cess collection for BOCW welfare.

5. ESIC for plantations

Optional coverage now permitted.

6. Decriminalisation and improvement notice

30-day mandatory notice before action.

Imprisonment replaced with fines for 13 offences.

7 offences compoundable (fine in lieu of imprisonment).

Encourages voluntary compliance and reduces litigation.

7. Inspector-cum-facilitator

Transparent, tech-driven, randomized inspections.

Focus on guidance over punitive action.

8. Compounding of offences

50% of maximum fine for fine-only offences.

75% for offences punishable with fine or imprisonment.

Helps avoid court delays; funds go to Social Security Fund.

Pro-employment Provisions

1. Career centres

Modern employment exchanges (digital + physical).

Employers must report vacancies → easier job matching.

2. Fixed-term employment benefits

Fixed-term employees receive:

Gratuity after 1 year

Same social security benefits as permanent staff

3. Universal coverage of workforce

(a) Gig and platform workers

Eligible for life, disability, health, maternity, and pension benefits.

(b) Unorganised/Self-employed workers

Eligible for customised social security schemes.

Conclusion

The Code on Social Security, 2020 brings India significantly closer to universal social protection.

It integrates nine laws, widens coverage to new workforce categories, empowers women, and strengthens digital governance.

It aligns with India’s inclusive development vision and supports the goal of Viksit Bharat 2047.

Prelims Practice MCQs

Q. Which of the following categories have been given formal recognition for social security for the first time under the Code on Social Security, 2020?

Gig workers

Platform workers

Home-based workers

A. 1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

Answer: A

(Home-based workers existed earlier under Unorganised Workers Social Security Act.)

Q. Under the Code, gratuity becomes payable to fixed-term employees after:

A. 6 months

B. 1 year

C. 3 years

D. 5 years

Answer: B

Q. Which of the following correctly describes the new definition of “wages” under the Code on Social Security, 2020?

A. Includes only basic pay

B. Includes all allowances

C. Includes basic pay, dearness allowance, and retaining allowance

D. Includes only allowances exceeding 50% of total remuneration

Answer: C