China’s Complaint Against India’s PLI Schemes at WTO

Background

China filed a complaint (2025) against India at the World Trade Organization (WTO).

It alleges that India’s Production Linked Incentive (PLI) schemes provide prohibited subsidies that violate WTO rules.

PLI Scheme

Launched: 2020

Objective: Boost Indian manufacturing, integrate MSMEs, strengthen global value chains.

Incentive: Financial rewards based on incremental sales in strategic sectors.

Schemes under challenge by China:

PLI for Advanced Chemistry Cell (ACC) batteries – aims to build giga-scale battery manufacturing in India.

PLI for Auto sector – supports production of Advanced Automotive Technology (AAT) vehicles and components.

PLI for Electric Vehicles (EVs) – attracts global EV manufacturers to India.

China’s Allegations

India’s PLI schemes violate WTO’s SCM (Subsidies and Countervailing Measures) Agreement.

Claims the subsidies are contingent upon Domestic Value Addition (DVA) — hence Import Substitution (IS) subsidies.

Examples:

Auto sector PLI → requires 50% DVA.

ACC battery PLI → requires 25% DVA.

China’s argument: These incentives discriminate against foreign goods, particularly Chinese imports.

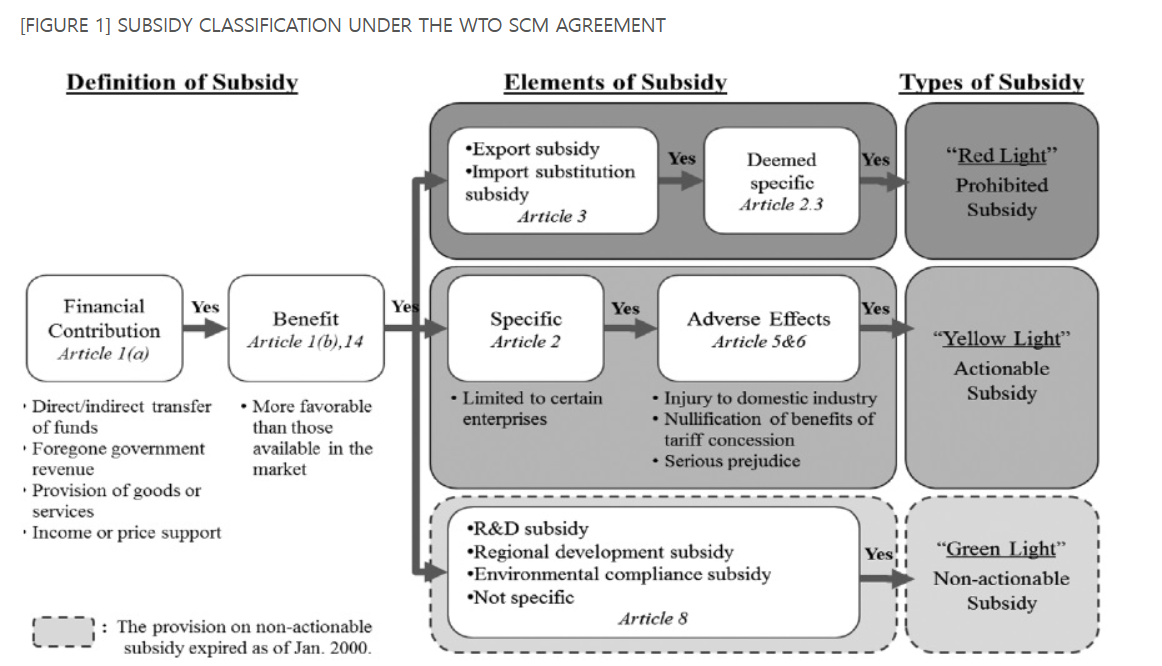

WTO Law on Subsidies

SCM Agreement (Subsidies and Countervailing Measures)

Defines a subsidy as:

A financial contribution by a government/public body

That confers a benefit

And is specific to an enterprise/industry

Types of Subsidies

Prohibited subsidies

(a) Export subsidies – tied to export performance

(b) Import Substitution (IS) subsidies – tied to use of domestic goods over imports (Article 3.1(b))

Actionable subsidies

May be challenged if they cause adverse effects to another member.

Non-actionable subsidies

e.g., R&D, environmental, or regional development subsidies.

Other WTO Provisions Involved

GATT Article III.4 (National Treatment Obligation)

Imported goods should not be treated less favorably than domestic goods.

TRIMs Agreement (Trade-Related Investment Measures)

Article 2.1: No TRIM inconsistent with national treatment.

Annex Illustration: Prohibits local content requirements.

Therefore, an Import Substitution subsidy also violates GATT and TRIMs obligations.

India’s arguement

The DVA requirement is not equal to Local Content Requirement.

Value addition can occur through:

Domestic assembly,

Indigenous R&D,

Technological innovation — not just local goods usage.

Thus, PLI doesn’t automatically breach WTO law.

Next Steps in WTO Process

Consultation Stage: India & China must first attempt a mutual resolution.

Panel Stage: If unresolved, a three-member WTO panel will adjudicate.

Appeal Stage: WTO Appellate Body is non-functional since 2019, so appeals will delay enforcement.

Result: Status quo may continue until dispute resolution reforms occur.

Prelims Practice MCQ

Q. Under the WTO’s Subsidies and Countervailing Measures (SCM) Agreement, a subsidy is considered prohibited if:

It is contingent on export performance.

It is contingent upon the use of domestic goods over imported goods.

It is given to the agricultural sector only.

Which of the statements given above are correct?

A. 1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

✅ Answer: A

Explanation:

The SCM Agreement prohibits export subsidies and import substitution (IS) subsidies, as per Article 3.1(a) and 3.1(b) respectively.

Agricultural subsidies are separately governed under the Agreement on Agriculture, not SCM.

Q. In WTO dispute settlement, what happens if a panel’s ruling is appealed while the Appellate Body remains non-functional (as it has since 2019)?

A. The panel’s ruling becomes final and binding.

B. The dispute goes to the International Court of Justice.

C. The case remains in limbo, with no enforceable ruling.

D. The WTO Director-General gives an ad hoc decision.

✅ Answer: C

Explanation:

Since the Appellate Body has been incapacitated since December 2019, any appeal leads to a “legal void”, leaving the dispute unresolved. This effectively maintains status quo — the panel decision is suspended.

Q. Which of the following correctly differentiates “Actionable” and “Prohibited” subsidies under the WTO’s SCM Agreement?

Type of Subsidy | Example | Legal Status |

A. Actionable | Subsidy causing “adverse effects” to another country’s trade | Challengeable if harm proven |

B. Prohibited | Export-linked subsidy | Automatically illegal |

Choose the correct answer:

A. Only A is correct

B. Only B is correct

C. Both A and B are correct

D. Neither A nor B is correct

✅ Answer: C

Explanation:

Actionable subsidies are not per se illegal, but can be challenged if they cause trade distortion.

Prohibited subsidies (like export or import substitution subsidies) are automatically illegal.