China and Rare Earth Elements (REEs)

Overview

-

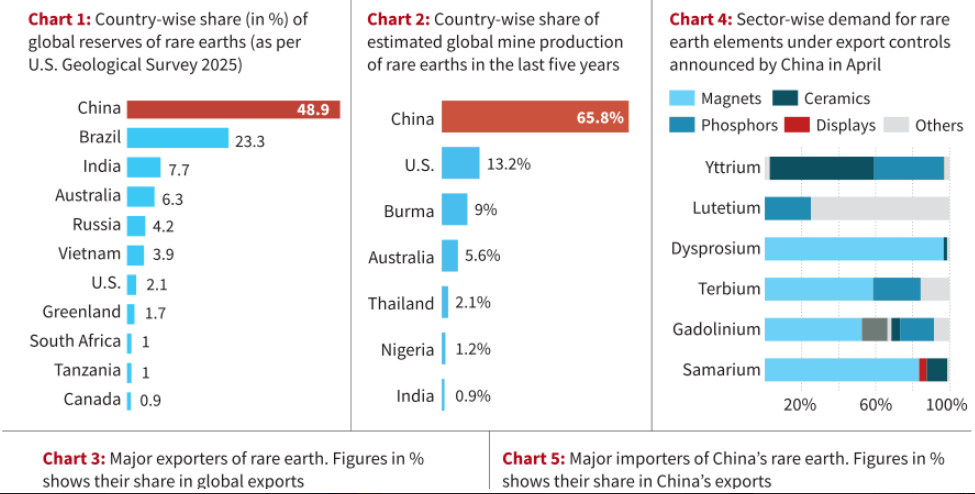

China is the world’s largest producer of rare earths, contributing >60% of global production.

-

Dominates the value chain: ~92% of global refining capacity, largest exporter (~30% of global demand).

-

Rare earths are vital for clean energy, defense, and high-tech industries (EVs, wind turbines, smartphones, hard drives).

-

China holds ~50% of global REE reserves.

Rare Earth Elements (17 metals)

| Type | Examples |

|---|---|

| Light REEs (LREEs) | Lanthanum, Cerium, Praseodymium, Neodymium, Samarium, Europium |

| Heavy REEs (HREEs) | Gadolinium, Terbium, Dysprosium, Holmium, Erbium, Thulium, Ytterbium, Lutetium, Scandium, Yttrium |

| Not included | Promethium (radioactive, not mineable) |

China’s Measures and Controls

-

April 2025: Export restrictions on 7 rare earth elements (including NdFeB magnets).

-

Companies must operate under government-set quotas and obtain approval for trade.

-

Previous measures:

-

Ban on exporting extraction/separation tools and methods

-

Ban on processing technology exports (Dec 2023)

-

Global Dependence

-

U.S.: Second-largest importer; heavily reliant on China.

-

India: >75% of rare earth imports from China since 2021.

-

Other REE-rich countries: Brazil, Australia, India (deposits exist but production/refining limited).

Reasons for China’s Dominance

-

Resource availability: Holds half of global reserves.

-

Refining & production capacity: 92% of global refining.

-

Research strength: ~30% of global REE research publications.

-

U.S. & Japan: ~10% each

-

India: ~6%

-

-

High investment in exploration: ~$14 billion/year since 2022 (highest in past decade).

Strategic Importance

-

Rare earths critical for:

-

Electric vehicles, wind turbines (clean energy)

-

Defense applications (missiles, electronics)

-

High-tech devices (smartphones, computers)

-

-

China’s export controls highlight geopolitical leverage in global supply chains.