Carbon Border Adjustment Mechanism (CBAM) and Impact on india

Context:

As per European think tank Sandberg (2025): Indian exporters of iron and steel may pay about €301 million (~₹3,000 crore) in CBAM fees highest globally.

Introduction

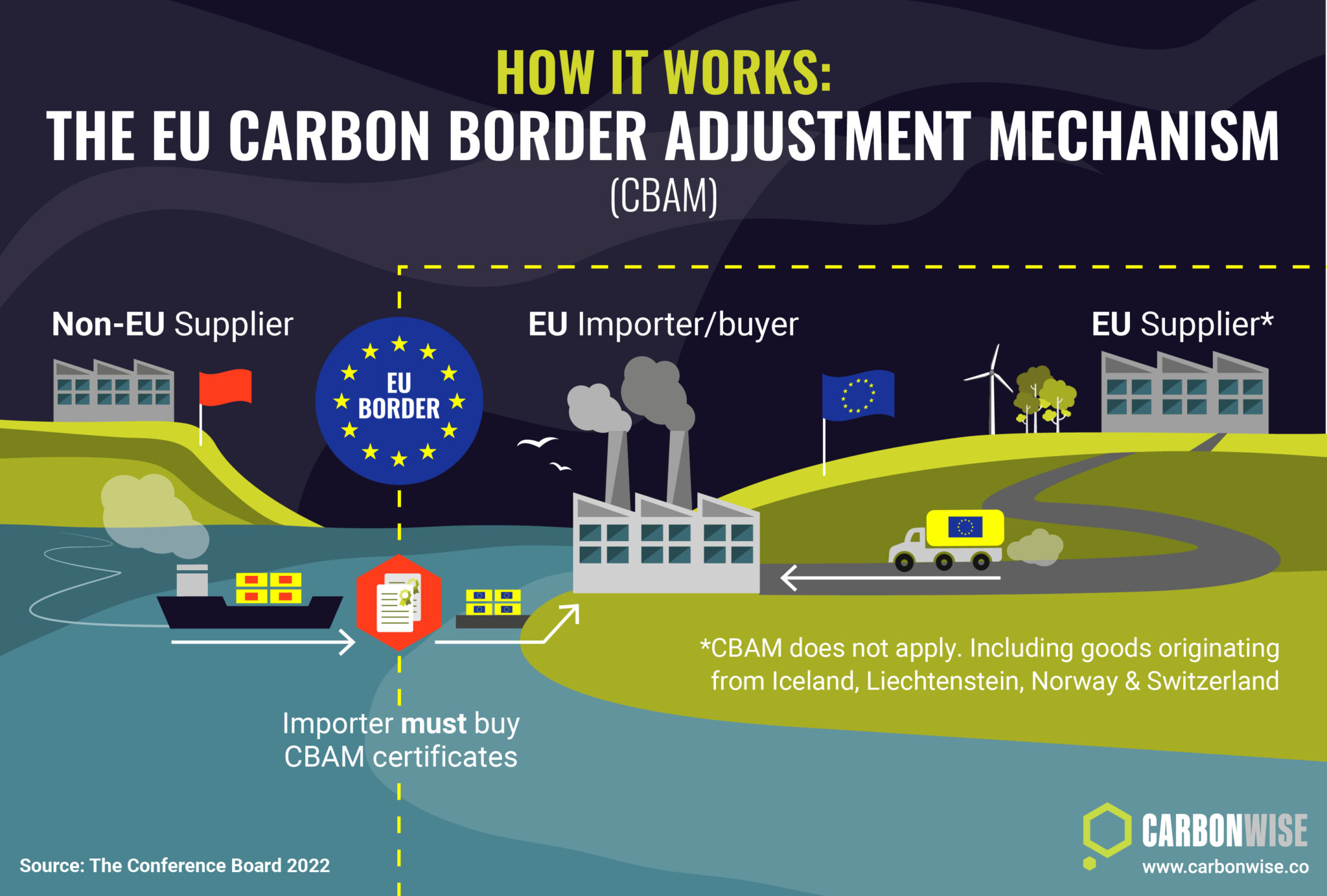

The European Union (EU) has introduced the Carbon Border Adjustment Mechanism (CBAM) to prevent “carbon leakage”.

It imposes a carbon levy on imports from countries where production emits more CO₂ than EU standards.

Objective: To ensure a level playing field between EU producers (who pay for carbon under EU Emission Trading System) and foreign exporters.

Mechanism

The European Union CBAM entered into force on May 17, 2023, with a transitional reporting phase beginning on October 1, 2023.

The definitive phase, where financial obligations will start, is set to commence on January 1, 2026.

its stated goal is to put a fair price on the carbon emitted during the production of carbon intensive goods that enter the EU.

This is to protect EU-based industries from unfair competition, and to encourage lower-carbon production in other countries.

EU importers must buy CBAM certificates corresponding to the carbon price that would have been paid if the goods were produced within the EU.

The levy applies only to direct emissions from production.

It encourages exporting countries to adopt low-carbon technologies.

Coverage (Initial Sectors)

Iron and Steel

Aluminium

Cement

(Later to extend to fertilisers, electricity, and hydrogen)

India’s Exposure and Liabilities

India is among the top exporters of iron and steel to the EU.

As per European think tank Sandberg (2025):

Indian exporters of iron and steel may pay about €301 million (~₹3,000 crore) in CBAM fees — highest globally.

Total Indian CBAM liability (including aluminium and cement): €330 million, about 1.05% of India’s total export value to the EU.

Russia (€240 million), Ukraine (€198 million), and China (€194 million) follow.

Opportunity for India

By adopting cleaner technologies, Indian exporters could:

Earn higher revenues estimated at €510 million

Achieve net cost reduction of around €180 million

Indicates the economic advantage of decarbonisation in manufacturing.

India’s Response

India has strongly opposed CBAM, calling it a non-tariff barrier.

Commerce Minister Piyush Goyal (July 2025) stated India may retaliate with taxes of its own if CBAM is imposed.

India argues that:

CBAM violates “Common but Differentiated Responsibilities” (CBDR) under the UNFCCC.

It undermines the principle of climate justice and equity for developing nations.

Implications for India

Trade Impact: May reduce competitiveness of Indian exports to the EU.

Industrial Transition: Push towards green steel, renewable energy, and low-emission manufacturing.

Policy Challenge: Need for national carbon pricing, green hydrogen adoption, and technology upgradation.

Diplomatic Dimension: Could trigger trade tensions between the EU and developing economies.

Way Forward

Accelerate green industrial policies (PLI for Green Hydrogen, National Steel Policy).

Establish carbon measurement and certification systems.

Collaborate with the EU for technology transfer and mutual recognition mechanisms.

Engage in WTO discussions to address the trade–climate overlap.