BRICS to Launch Investment Guarantee Fund

Why in news:

-

The BRICS group is preparing to launch a Multilateral Guarantee Fund, backed by the New Development Bank (NDB), to boost private and infrastructure investment in member and other developing nations.

Key Highlights:

-

Name of Fund: BRICS Multilateral Guarantee (BMG) Mechanism

-

Modelled on: World Bank’s Multilateral Investment Guarantee Agency (MIGA)

-

Purpose:

-

Reduce financing costs

-

Attract private capital

-

De-risk projects in infrastructure, climate adaptation, and sustainable development

-

Strengthen NDB’s role and relevance in global governance

-

-

Significance:

-

Responds to global investment uncertainties (e.g., US economic policy fluctuations)

-

Demonstrates BRICS unity and commitment to global south cooperation

-

No new capital contribution from member countries needed

-

Will leverage existing NDB resources

-

Expected Outcomes:

-

Each $1 in NDB guarantees is expected to mobilize $5 to $10 in private investment.

-

Pilot projects to begin receiving guarantees by 2026.

-

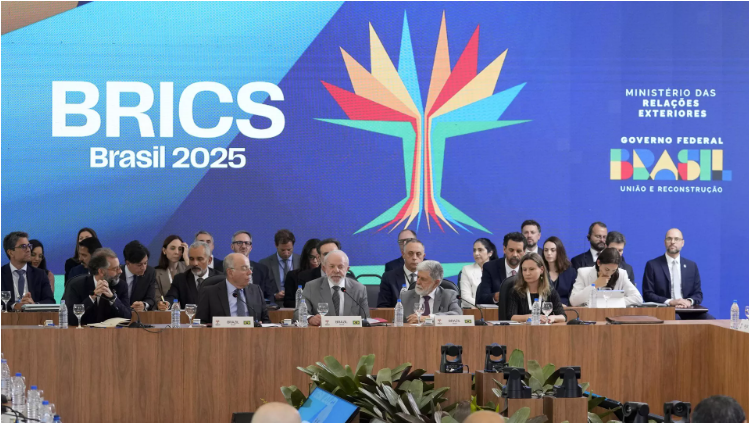

Seen as the flagship financial initiative of Brazil’s 2025 BRICS Presidency.

Status:

-

Has technical approval from all member countries.

-

Awaiting formal endorsement by BRICS Finance Ministers (expected soon).

-

To be included in BRICS Summit 2025 joint declaration (Rio de Janeiro).

Multilateral Investment Guarantee Agency (MIGA)

Established: 1988.

-

Headquarters: Washington D.C., USA.

-

Member of: World Bank Group (5th institution after IBRD, IDA, IFC, ICSID).

-

Main Objective: Promote Foreign Direct Investment (FDI) in developing countries by insuring against political and non-commercial risks.

-

Total Members: 182 (as of 2022), including 156 developing and 25 industrialized countries.

-

India is a member of MIGA.

Published reports like "World Investment and Political Risk".

Established: 1988.

Headquarters: Washington D.C., USA.

Member of: World Bank Group (5th institution after IBRD, IDA, IFC, ICSID).

Main Objective: Promote Foreign Direct Investment (FDI) in developing countries by insuring against political and non-commercial risks.

Total Members: 182 (as of 2022), including 156 developing and 25 industrialized countries.

India is a member of MIGA.

Published reports like "World Investment and Political Risk".

Core Functions:

MIGA provides insurance (guarantees) against five major non-commercial risks:

-

Currency inconvertibility and transfer restriction

-

Expropriation or nationalization

-

War, terrorism, and civil disturbances

-

Breach of contract by governments

-

Non-honoring of sovereign financial obligations

Instruments covered: Equity, shareholder loans, bonds, lease agreements, franchise/license contracts, and more.

Insurance Tenure: Up to 15 years (with a possible 5-year extension).

Dispute Resolution: Engages in mediation before disputes become formal claims; uses subrogation rights to recover compensation.