32nd Meeting of the Financial Stability and Development Council (FSDC) Sub-Committee

Financial Stability and Development Council (FSDC) & Sub-Committee

Background

-

Constituted: 2010 by then Finance Minister Pranab Mukherjee.

-

Idea Origin: Raghuram Rajan Committee (2008) on financial sector reforms recommended a super-regulatory body for systemic risk management.

-

Nature: Apex-level body to oversee macro-prudential regulation and financial stability.

-

Not a statutory body (no separate funds allocated).

-

Context of creation: Global Financial Crisis (2007–08) → need for stronger financial stability mechanisms.

Composition of FSDC

Chairperson: Union Finance Minister.

Members:

-

Governor, RBI

-

Finance Secretary &/or Secretary, Department of Economic Affairs (DEA)

-

Secretary, Department of Financial Services (DFS)

-

Secretary, Ministry of Corporate Affairs

-

Secretary, Ministry of Electronics & IT

-

Chief Economic Adviser (CEA)

-

Chairpersons of SEBI, IRDAI, PFRDA, IBBI

-

Additional Secretary (DEA) as Secretary of the Council

-

Special invitees as deemed necessary.

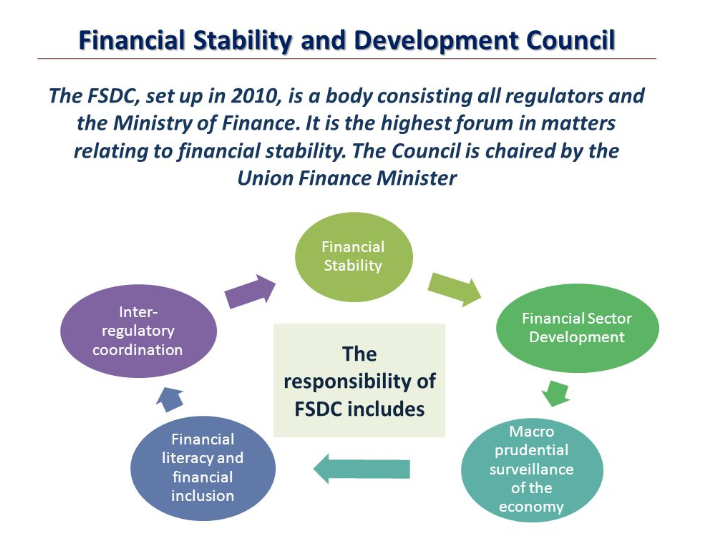

Responsibilities of FSDC

-

Financial Stability – monitoring risks & preventing crises.

-

Financial Sector Development – deepening capital markets, insurance, pensions.

-

Inter-Regulatory Coordination – resolving overlaps between RBI, SEBI, IRDAI, PFRDA.

-

Macro-Prudential Supervision – oversight of large financial conglomerates.

-

Financial Inclusion & Literacy – unique mandate compared to global counterparts.

-

Coordination of India’s interface with global financial bodies – FATF, FSB, IMF, etc.

Structural & Functional Aspects

-

Sub-Committee of FSDC (FSDC-SC):

-

Headed by Governor, RBI.

-

Replaced the High-Level Coordination Committee on Financial Markets.

-

Focuses on operational issues, inter-regulatory coordination, and monitoring systemic risks.

-

-

Regulators’ autonomy protected – FSDC provides coordination, not control.

32nd Meeting of FSDC Sub-Committee

-

Venue: Reserve Bank of India, Mumbai.

-

Chair: Shri Sanjay Malhotra, Governor, RBI.

- It includes all FSDC members, four RBI Deputy Governors, and the Department of Economic Affairs (DEA) Additional Secretary.

Key Discussions:

-

Global & Domestic Macroeconomic Developments – impact of trade uncertainty & geopolitical frictions.

-

Inter-Regulatory Issues:

-

Simplification of KYC processes.

-

Special drives for financial inclusion.

-

Review of State-Level Coordination Committees (SLCCs).

-

Activities of various technical groups.

-

-

National Strategy for Financial Inclusion (NSFI) 2025–30 – deliberated.

-

Commitment: Enhance financial sector resilience through coordination.

Significance

-

Strengthens India’s macro-prudential framework against financial shocks.

-

Addresses regulatory fragmentation across multiple agencies.

-

Supports financial inclusion goals through national strategies.

-

Provides early warning mechanism for systemic risks.

-

Enhances India’s credibility in global financial governance (FATF, FSB).